are charity raffle tickets tax deductible

The price of a raffle ticket is not deductible. To claim a deduction you must have a written record of your donation.

For The Ask Kids Charity Raffle

The purchase of a raffle ticket is not considered a charitable donation.

. The IRS has determined that purchasing the chance to win a prize has value that is essentially. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organizationThe IRS considers a raffle ticket to be a contribution. However the answer to why raffle tickets are not tax-deductible is quite simple.

This is because the purchase of raffle. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

If the organization fails to. The IRS has determined that purchasing the chance to win a prize has value that is. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had. As a result your charitable contribution. The value of the various.

Withholding Tax on Raffle Prizes Regular Gambling Withholding. There is the chance of winning a prize. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

So can i deduct the money for the tickets as a. Are raffle tickets for a nonprofit tax-deductible. Exceptions for Charity Raffle Donations.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. The amount of your state tax credit does not exceed 15 of the fair market value of the painting. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its.

Are fundraisers tax deductible. Are raffle tickets for a nonprofit tax-deductible. The only time you can deduct the cost of raffle tickets you purchase from a charity is when you report any type of gambling winnings on.

What you cant claim. An organization that pays raffle prizes must withhold 25 from the winnings and report this. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

Porte Brown answers the most common questions regarding charitable contributions. The cost of a raffle ticket is not. The state tax credit is 10000 10 of 100000.

This might sound nonsensical on the. What tax implications are there for an. An organization that pays raffle prizes must withhold 25 from the winnings and report this.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. You cant claim gifts or donations that provide you with a personal benefit such as. Are charity raffle tickets tax deductible.

What about raffle tickets. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

Luck Of The Griffin Mega Raffle Fr Mcgivney Catholic High School Glen Carbon Il

Holiday Shop Dine Southern Shooters Supply S Charity Raffle Lifestyle Tehachapinews Com

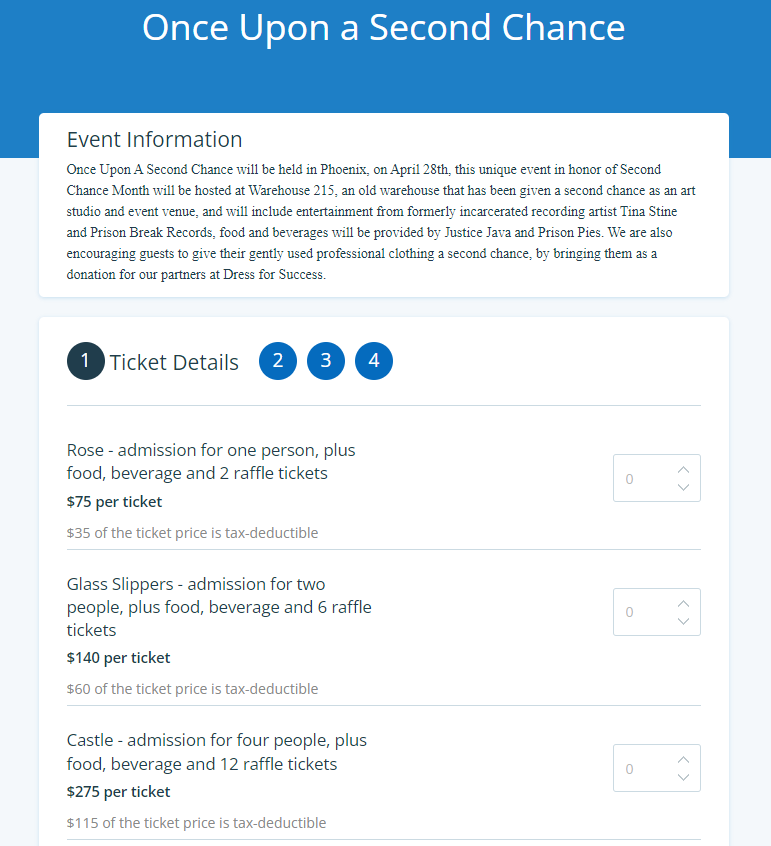

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Rotary Rocks The Raue 50 50 Raffle By Rotary Club Of Crystal Lake Dawnbreakers Charity Betterunite

Pay Taxes On Church Raffle Prize Winnings

Raffle Rules And Info Page Blackfriars Theatre

How To Get A Tax Deduction For Supporting Your Child S School

Blog Small Business Deductions For Charitable Giving Montgomery Community Media

Cares Act Changes Deducting Charitable Contributions Made In 2020 Karen Ann Quinlan Hospice

Autograph Football Derek Carr 4 Raffle Ticket 5 00 Overflow Sports Academy

Charitable Giving Considerations Forvis

Annual Charity Raffle Tickets For Sale Now

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Raffle Labette Community College

Are Nonprofit Raffle Ticket Donations Tax Deductible

Fun Fact Charity Raffle Tickets Are Not Tax Deductible